The Seven Deadly Sins at Tinder and PokerStars

Investors want to know why customers use a company’s products/services. Often this is referred to as the ‘customer value proposition’ or the ‘customer ROI’. The Seven Deadly Sins helps us understand situations where that value proposition isn't entirely rational.

Investors want to know why customers use a company’s products/services. Often this is referred to as the ‘customer value proposition’ or the ‘customer ROI’.

However, there are many consumer businesses out there that do not offer their customers rational ‘value’ but are nonetheless incredibly powerful businesses with very loyal customers.

What gives?

The Seven Deadly Sins is a helpful framework for understanding customer behaviour in these situations.

Outline for this post:

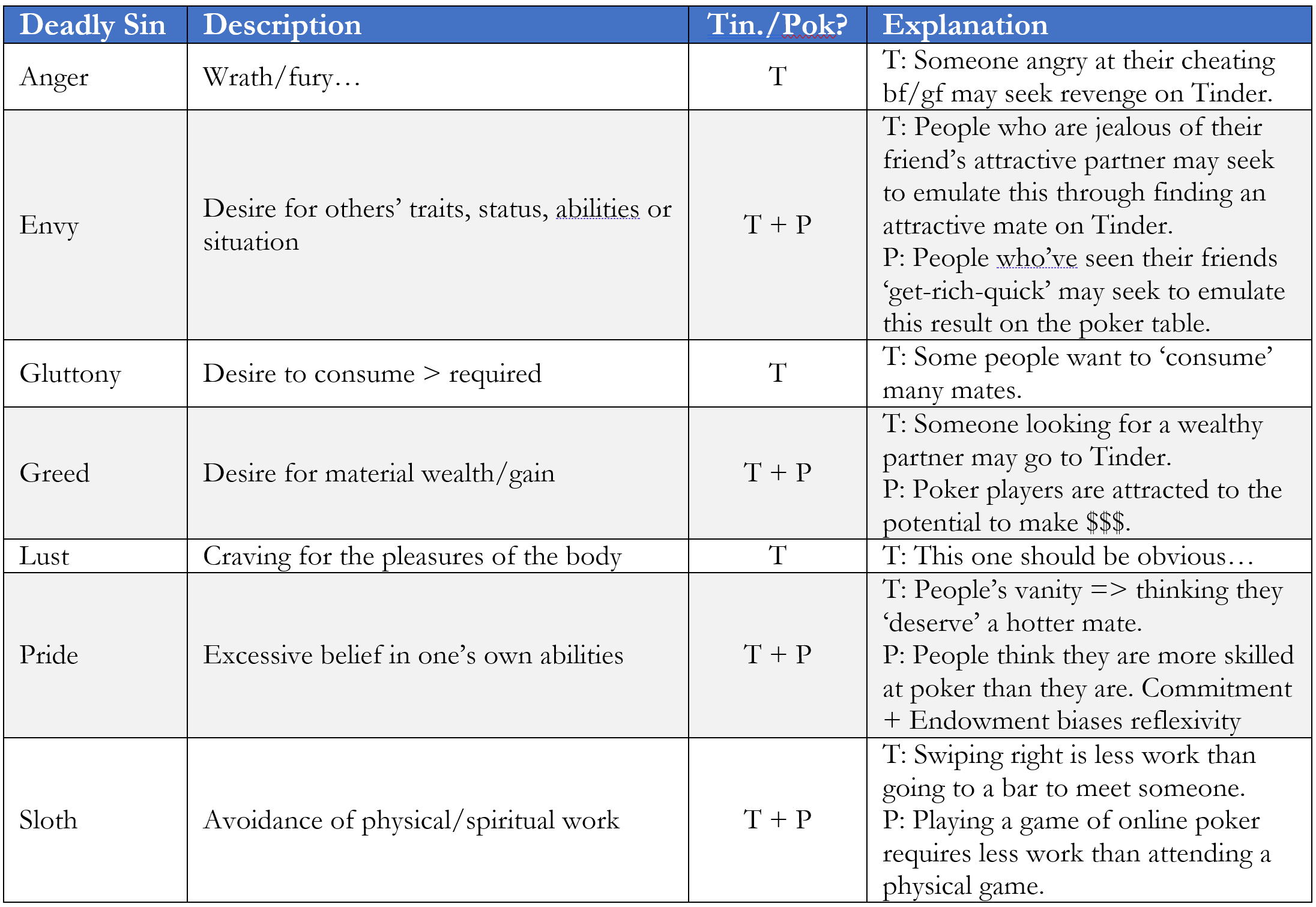

- Which of the Seven Deadly Sins do Tinder and PokerStars tap into?

- How is this working for Tinder and PokerStars's businesses?

- Summary

- Questions for further research/pondering

1: Which of the Seven Deadly Sins do Tinder and PokerStars tap into?

Most internet business models tap into Sloth (and indeed most good businesses do – few people like to work harder than they need to!) Lust and Anger are very unusual Sins for businesses to tap into.

Tinder is the only business I’ve come across that appeals to all seven of the Deadly Sins.

Some of these Sins only appeal to a small group of Tinder/PokerStars customers. For example – Anger: not everyone on Tinder is seeking revenge over their ex!

It’s worth considering each Sin if it:

- Is relevant for a meaningful percentage of the customer base, or

- Is a strong motivator for at least a small percentage of the customer base.

2: How is this working for Tinder and PokerStars’s businesses?

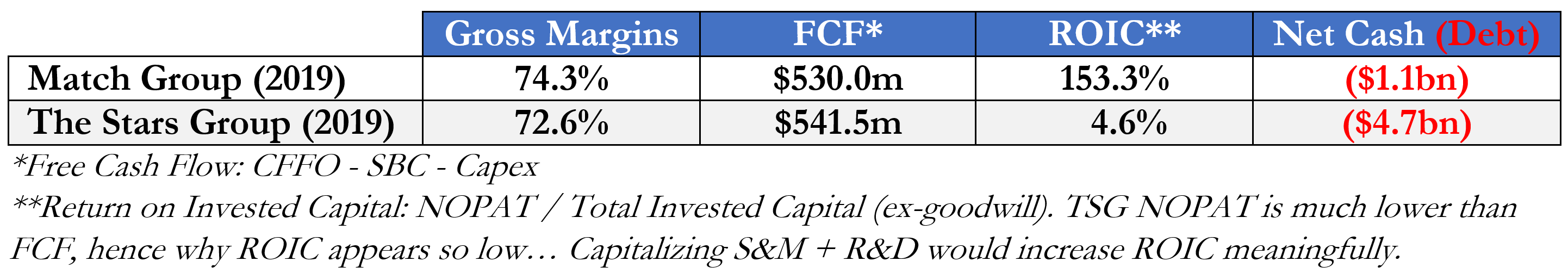

These businesses have strong economic models:

3: Summary

The Deadly Sins provide us insight into what lures customers back to these businesses over and over.

However, tapping into the Sins is an insufficient condition for generating sustainably high returns on capital since any copycat business in the same industry would benefit from the same Sins, too.

To understand why Tinder and PokerStars generate high returns on capital, we’d also need to consider:

- These businesses’ customer value propositions compared to alternative options for the customer (i.e. compared to a competitor company and compared to a substitute product/service),

- Their competitive advantages (e.g. network effects, economies of scale, brand etc), and

- The competitive landscape in which they compete.

The Seven Deadly Sins complement the strong network effects these businesses benefit from. The Sins enhance customer stickiness and afford these businesses additional pricing power.

It’s impossible to say how much of their operating results come from the Sins vs the myriad other factors that impact their businesses, but based on their financials it doesn’t look as though they’re being punished for their customers’ sins!

The Seven Deadly Sins passes the ‘All models are wrong but some are useful’ test.

4: Questions for further research/pondering

- Is it more important to tap into multiple Sins or to really nail one Sin?

- Should I be ‘scoring’ these businesses across each Sin (on a scale of 1-10 for example) rather than just yes/no? If so should I add up the total scores and use that as a metric of overall strength?

- Does it matter if the Sin in question only appeals to a select group of customers, but appeals to that group strongly? Or should the Sin only be considered if it applies to a 'meaningful' proportion of the customer base?

- Do enterprise software businesses only tap into Sloth?

- Is Sloth the most important Sin? In what situations do people want to work harder than they have to - assuming the product/service is equal in overall quality/data-quality, etc?

- Do the Seven Deadly Sins matter for non-consumer businesses? Other than Sloth...