Scale Economies Shared

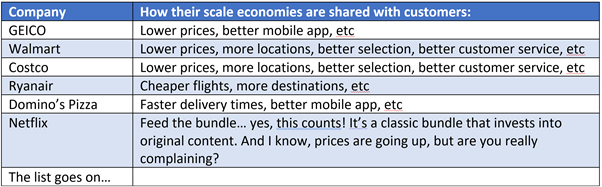

Scale Economies Shared businesses have a flywheel because their competitive advantages increase as the business grows larger, making it harder and harder for competitors to offer as much value to customers.

Summary: Capitalism works: high profits attract competition which lowers profits. However, a select few businesses such as Amazon and Costco have seemingly become stronger as they've gotten bigger. How is this possible? What has enabled them to defy capitalism? Becoming stronger as one grows bigger is possible through supply-side flywheels (aka “Scale Economies Shared” or “SES” businesses) and/or demand-side flywheels (aka network effects).

I discussed network effects in a former post. In this post I discuss scale-economies-shared businesses. Note that the term "scale economies shared" was coined by Nick Sleep and Qais Zakaria of Nomad Partners.

Outline for this post:

- Back-to-basics - What are economies of scale?

- Back-to-basics - What is a flywheel?

- What is the strategy of SES businesses and why do they have a flywheel?

- Examples of SES businesses:

a. Charles Schwab

b. The New York Times

c. Amazon - How can SES businesses go wrong?

- Closing comments

- Appendices:

a. The Robustness Ratio

b. Jeff Bezos on Amazon's flywheel(s)

c. Charles Schwab on SCHW's flywheel

d. Meredith Kopit Levien on the NYT’s flywheel

e. Mark Thompson on the NYT's flywheel

f. Resources

1: Back-to-basics – What are economies of scale?

From my post on fixed costs:

Economies of scale, as defined by 7 Powers, produce “a business in which per unit cost declines as production volume increases.” This can result in highly attractive margins for the leading company in an industry.

Let’s use a simplified example to demonstrate this: When evaluating the cost of buying a show for $10m, a SVOD (Streaming Video On Demand) provider with only 10m subscribers faces $1/sub in content cost, whereas a leading SVOD with 100m subs faces just $0.10/sub cost. That leads to much more attractive profit margins for the leader. In this situation the leader could outbid the smaller SVOD provider by 5x and still earn 2x the margins on a per-subscriber basis than the #2 player.

Economies of scale in leveraging a fixed cost can be extremely powerful!

2: Back-to-basics – What is a flywheel?

The “flywheel” is a concept coined by Jim Collins. To paraphrase:

A flywheel is a heavy wheel that requires a large, sustained effort to push. Initial efforts result in the flywheel barely moving. But, as you push, the flywheel begins to build momentum. Keep pushing & eventually it generates enough momentum to spin itself with minimal additional effort from you. The trick is to push hard enough & long enough to get it going, and to keep accelerating it with additional pushes along the way.

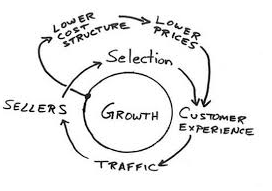

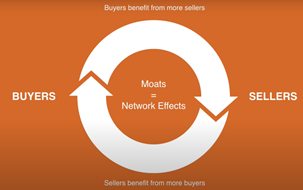

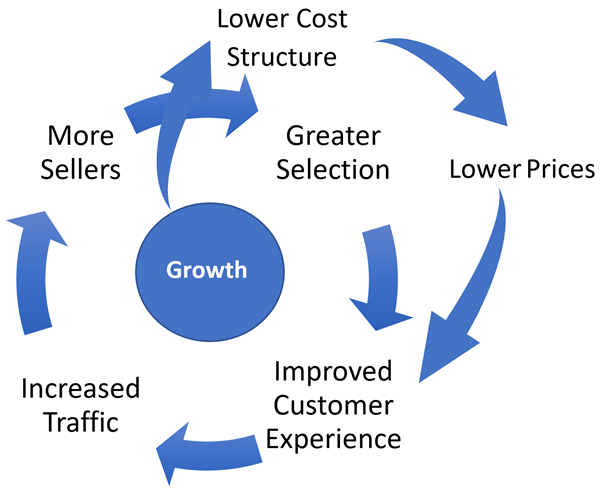

The following image is taken from an Andreessen Horowitz presentation on Marketplaces, and demonstrates the network effects flywheel present in many online marketplaces:

3: What is the strategy behind SES businesses and why do they have a flywheel?

The strategy of SES is where a company benefitting from economies of scale chooses to lower its prices and/or improve its offerings to customers in order to win market share over the long-term, rather than pricing its products & reducing its investments to maximize per-unit profit in the short-term.

SES businesses have a flywheel because their competitive advantages increase as the business grows larger, making it harder and harder for competitors to offer as much value to customers.

SES businesses embrace delayed gratification (in the form of long-term shareholder value) while giving their customers instant gratification (in the form of immediate increased value proposition of the company’s goods/services). SES businesses reinvest their scale benefits into improving the customer value proposition, even if the financial return on the investment isn’t immediate (or even guaranteed).

Flywheel specifics vary across industries.

The most obvious example of “scale economies shared” is in businesses like Walmart and Amazon where scale enables them to lower prices for consumers – “sharing” that scale through price reductions.

But “sharing” scale doesn’t always have to be through reducing price – it can be through investing in improving the customer experience in other ways, too, such as increasing selection and convenience. The value proposition to customers should increase over time while the business’s financial profile improves, too. This is an incredibly powerful, albeit rare, combination.

Jeff Bezos, Amazon's founder & CEO, stated in his 2015 letter to shareholders:

“We want Prime to be such a good value, you’d be irresponsible not to be a member.”

Bezos deeply understands the benefits of sharing scale advantages with customers.

4: Examples of SES businesses:

In this post we’ll examine the following companies under the SES framework:

- Charles Schwab

- The New York Times

- Amazon (Core retail business + Amazon Prime + Amazon Web Services)

Charles Schwab (SCHW):

Schwab and Interactive Brokers share many of the same attributes on this front, but I’ve chosen to discuss Schwab since I recently finished reading “Invested” by Charles Schwab himself and it is a far larger business in terms of client assets with a longer operating history.

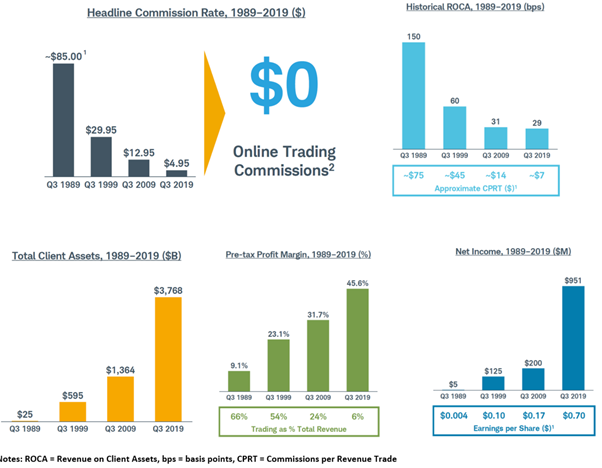

On October 1st 2019 Charles Schwab responded to the launch of Interactive Brokers Lite by taking trading commissions to zero across US & Canadian stocks, ETFs and options. Schwab took SES to a level unmatched by any of the other examples here: it no longer charges for its primary service to clients. By taking commissions to zero, Schwab killed the business model it started with on May 1st, 1975 (aka May Day, when the SEC deregulated trading commissions).

Schwab is able to do this because it invests the cash balances of its customers into interest-bearing assets. Schwab charges its customers an implicit fee based on the opportunity cost of their cash balances, rather than an explicit fee. At any one client this cash may only amount to a few hundred dollars, but pooled together it’s ~$350bn.

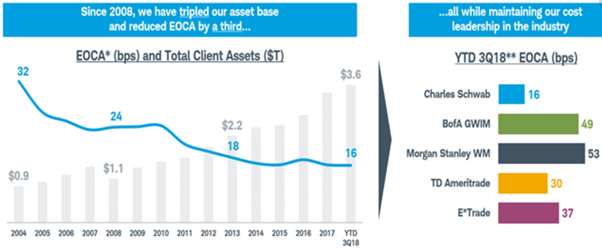

The below is an old image (taken from Q3 2018), but the trend has continued since then:

EOCA stands for ‘expenses on client assets’ and is a measure of exactly that. The lower your EOCA, the lower your cost structure and the cheaper you can offer your services to customers.

It’s hard to undercut a business that doesn’t charge explicit fees and has high-quality service. Other businesses like Robinhood and Interactive Brokers must compete on product usability and other features, which Schwab continues to invest in.

Read the appendix 'Charles Schwab' for some great quotes from the man himself in his book 'Invested'.

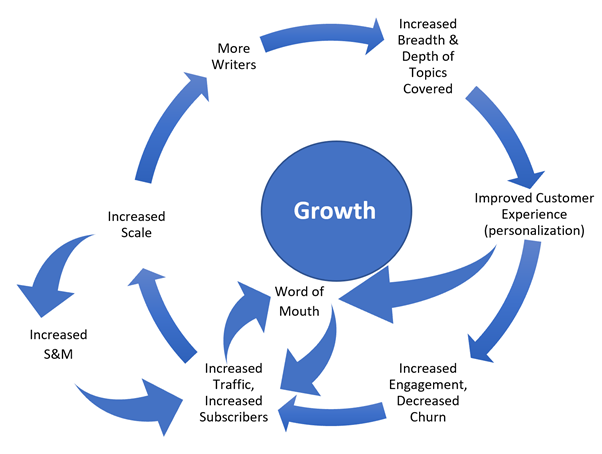

The New York Times (NYT):

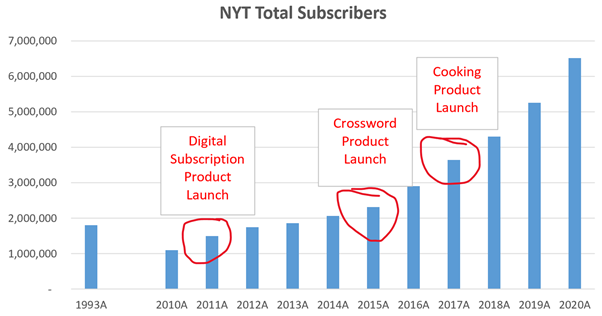

Unlike Schwab, the New York Times doesn’t share its scale with customers through lowering prices. Instead, it shares its scale by reinvesting back into its digital bundles in news & other offerings (e.g. by hiring additional journalists to cover more stories and by improving 'discoverability' of stories on its website and mobile app). This adds to both the breadth and depth of its offerings, both of which provide a better value proposition to customers. In short, the NYT shares its scale economies with readers & subscribers by feeding its bundle:

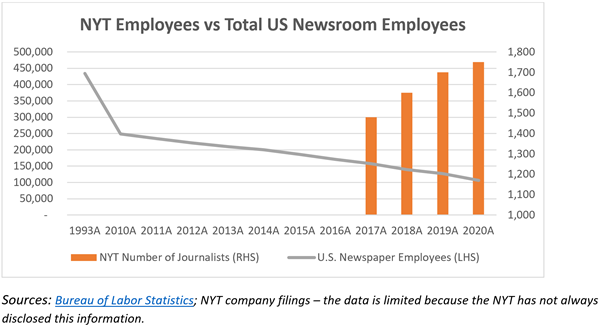

The NYT has economies of scale in content creation and highly attractive incremental economics, particularly in its digital subscription products. They’ve gained meaningful market share. The NYT has hired journalists while industry-wide the trend has been the opposite. The NYT has been able to hire great talent away from less financially-stable news organizations:

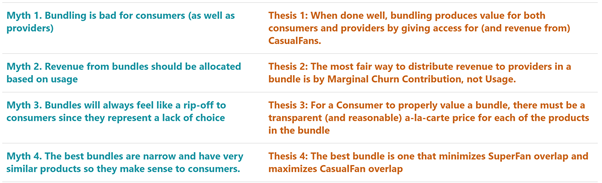

For subscription businesses like the NYT and Amazon Prime, it’s critical that they internalize the Four Myths of Bundling (full credit to Shishir Mehrotra for this wonderful framework):

The NYT is popular among its users for its political commentary & analysis. I would like to see the NYT take Shishir’s Thesis 4 to heart in particular, and accelerate its investments in the following:

- Sports – particularly sports that are popular internationally such as cricket and soccer where ‘casual fan’ overlap is likely to be the highest with its core news offering

- Business and economics – again, there is a lot of casual fan overlap

- Other niche topics such as gardening & true crime that the NYT can offer as standalone products & also bundle with the news product - similar to the Times’s Cooking product and its Crossword product

Amazon (AMZN):

Amazon’s retail business:

Amazon is the king of flywheels - both supply-side- and demand-side-flywheels. I suggest reading Zack Kanter’s post “What is Amazon?” and all of Bezos’s letters to shareholders chronologically since Amazon’s IPO.

Low prices and high profits rarely come together. It’s only possible to achieve this if your business has a sustainable cost advantage over competitors through economies of scale.

Bezos has written about this many times in his annual letters to shareholders. For example (from his 2001 annual letter to shareholders):

Focus on cost improvements makes it possible for us to afford to lower prices, which drives growth. Growth spreads fixed costs across more sales, reducing cost per unit, which makes possible more price reductions. Customers like this, and it’s good for shareholders. Please expect us to repeat this loop.

Please see the appendix ‘Bezos’ for more examples.

Brad Stone wrote the best book on Amazon to date called ‘The Everything Store’. In it he describes Amazon’s flywheel multiple times, which I’ll paraphrase here:

Bezos & his lieutenants sketched their own virtuous cycle, which they believed powered their business: lower prices led to more visits. More customers increased the volume of sales & attracted more commission-paying third party sellers to the site. That allowed Amazon to get more out of the fixed costs like the fulfillment centers & the servers needed to run the website. This greater efficiency then enabled it to lower prices further. Feed any part of this flywheel, and it should accelerate the loop.

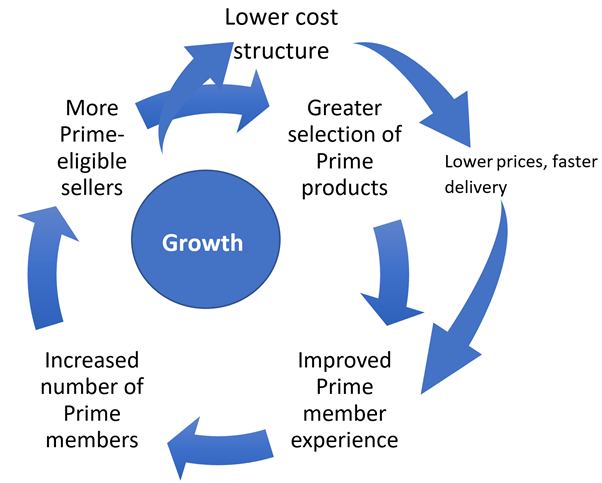

The following is an image of this in action:

The customer is at the heart of any business. Amazon’s core objective is to improve the customer experience, which it does in five ways:

- Reduce prices

- Reduce delivery times

- Increase selection

- Increase personalization of the site to users (better user experience + enabling discovery)

- Guarantee satisfaction (easy returns, product quality, etc)

All of the operational complexity in the background is in service of these five things that customers always want more of.

Amazon Prime:

Amazon Prime is an interesting take on this flywheel, but ultimately:

its algorithm – borrowed and modified from Walmart – was simple: a) vast selection, b) delivered fast, c) at the lowest possible prices, d) backed by guaranteed satisfaction.

On a per customer basis, Prime members order more items, across more categories, than non-Prime members. Amazon thus feeds the Prime bundle:

When Amazon launched Prime in 2004 it was a simple value proposition: all-you-can-eat, two-day shipping for a flat annual fee. At that time, there were one million eligible Prime products. By 2013, Amazon passed 20 million eligible products. Today more than 100m products are eligible for 2-day shipping in the US.

Amazon made Prime better in other ways too, adding digital products such as Prime Video, Prime Day, discounts to Amazon Music and other products, credit cards, free photo storage on Prime Photo, and more. It’s no wonder Amazon passed 100m Prime members in 2017.

Bezos included a quote from a Prime customer in his 2012 letter to shareholders that sums it up:

Thank you. Every time I see that white paper on the front page of Amazon, I know that I’m about to get more for my money than I thought I would. I signed up from Prime for the shipping, yet now I get movies, and TV and books. You keep adding more, but not charging more. So thanks again for the additions.

Bezos continues:

We now have more than 15 million items in Prime, up 15x since we launched in 2005. Prime Instant Video selection tripled in just over a year to more than 38,000 movies and TV episodes. The Kindle Owners’ Lending Library has also more than tripled to over 300,000 books, including an investment of millions of dollars to make the entire Harry Potter series available as part of that selection. We didn’t “have to” make these improvements in Prime. We did so proactively. A related investment – a major, multi-year one – is Fulfillment by Amazon. FBA gives third-party sellers the option of warehousing their inventory alongside ours in our fulfillment center network. It has been a game changer for our seller customers because their items become eligible for Prime benefits, which drives their sales, while at the same time benefitting consumers with additional Prime selection.

Amazon Prime is a classic bundle. While the annual cost of a Prime membership has increased in recent years, the benefits added (i.e. faster delivery times, cheaper products, more products available for 2-day shipping, wider assortment of products available in the bundle, etc) outweigh the additional cost of the membership fee.

Prime is an example of increasing the explicit cost of the bundle while reducing the actual cost of the bundle due to increasing the value proposition to customers.

Bezos would be proud - it is indeed irresponsible to not be a Prime member.

Amazon Web Services:

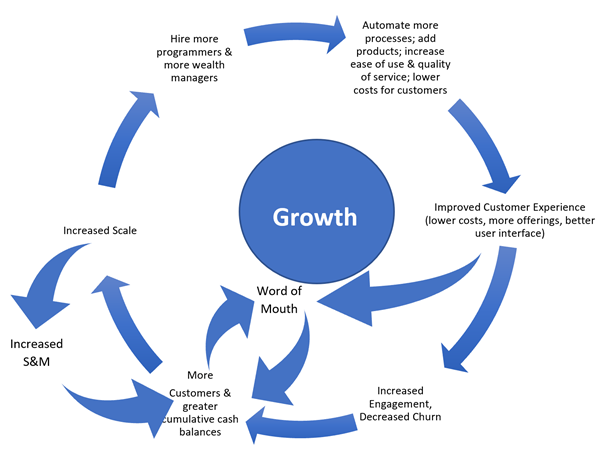

The flywheel at AWS should be recognizable by now, with some differences in the specifics:

5: How can SES businesses go wrong?

SES businesses can go wrong in one of five ways:

- They aren’t really SES businesses

- They are potentially SES businesses but they get outcompeted at an early stage of building the flywheel by someone doing this even better

- They lose sight of what the customer really wants

- They get disintermediated

- They don’t operate with an efficient cost structure

Jeff Bezos has an interesting four-part framework that I’ll discuss, too.

1: They aren’t really SES businesses

For a great framework on this topic, please refer to the following HBR post:

The Fine Line Between When Low Prices Work and When They Don’t (hbr.org):

- They have a low price position from day one

- They have a high-growth, high-revenue focus

- They are extremely efficient

- They guarantee adequate and consistent quality

- They focus on core products

- Their ads focus on price

- They never mix their messages

Most businesses do not have SES flywheels. Looking for them everywhere runs the risk of seeing them everywhere, even where they're not present. You should assume flywheels are not present as your default view.

The key questions are:

“Is this a business in which per unit costs decline as production volumes increase?”

Secondly:

“Is management taking action to increase the value proposition to its customers as it adds more customers, working backwards from customer needs?”

Thirdly:

"Is the company's culture deeply aligned with customers and the 'SES' mission?"

And fourthly:

"Is the customer value proposition increasing relative to competitors over time?"

It’s important that these businesses have some degree of customer captivity as they scale – typically it’s switching costs, but it could be brand and/or network effects. If all they can have is economies of scale, it will be very difficult to keep customers if someone comes along discounting prices irrationally.

2: They get outcompeted at an early stage of building the flywheel by someone doing this even better

While the movie is still yet to play out, a current example of this might be Vroom lacking scale vs Carvana.

3: They lose sight of what the customer really wants

Gillette used its scale to create better and better razors, and in-so-doing raised not only the technical abilities of its razors beyond what’s ‘needed’, but also increased its price points well beyond what’s ‘wanted’. Gillette focused too much on the premium segment of the market and neglected the entry-level, thus creating an opportunity for Dollar Shave Club and Harry’s and other brands to steal potential and actual customers by offering an adequate-quality razor at a much lower price point.

Bloomberg is a fantastic company, however, a legion of startups including Koyfin, Sentieo, Unhedged etc have popped up with cleaner user interfaces and simpler products at lower (or free) price points. Bloomberg seems to have lost sight of the fact that most users don’t need all the functionality they offer in their bundle – a ‘Bloomberg Lite’ would be an effective solution to this, albeit less effective today than it would have been ten years ago.

As Bezos said in his 2008 letter to shareholders:

Long-term orientation interacts well with customer obsession. If we can identify a customer need and if we can further develop conviction that that need is meaningful and durable, our approach permits us to work patiently for multiple years to deliver a solution. “Working backwards” from customer needs can be contrasted with a “skills-forward” approach where existing skills and competencies are used to drive businesses opportunities. The skills-forward approach says, “We are really good at X. What else can we do with X?” That’s a useful and rewarding business approach. However, if used exclusively, the company employing it will never be driven to develop fresh skills. Eventually the existing skills will become outmoded. Working backwards from customer needs often demands that we acquire new competencies and exercise new muscles, never mind how uncomfortable and awkward-feeling those first steps might be.

I would only add that working backwards demands considering not only product innovations, but also delivery-model innovations (e.g. direct-to-consumer/online vs offline, etc).

d) They get disintermediated

Gillette also used its scale to purchase prominent shelf space in retail stores worldwide. The internet disintermediated this advantage (to a large degree, albeit not entirely) and Dollar Shave Club was early enough to take advantage and acquire customers with a more customer-convenient delivery model (direct-to-consumer).

The quintessential example of a company with economies of scale was Intel, but even they have been surpassed by TSMC. Only the paranoid – and customer-obsessed – survive…

e) They don’t operate with an efficient cost structure

Scottrade and other brokerage firms have been outcompeted by Interactive Brokers due to Interactive Brokers’ lower cost structure: Interactive Brokers has no physical stores and has invested more resources in its digital offerings. Robinhood is pursuing a similar strategy, with a more stripped-down product offering (and more dubious business practices).

Here’s Bezos in 2008:

The customer-experience path we’ve chosen requires us to have an efficient cost structure. The good news for shareowners is that we see much opportunity for improvement in that regard. Everywhere we look (and we all look), we find what experienced Japanese manufacturers would call “muda” or waste. I find this incredibly energizing. I see it as potential – years and years of variable and fixed productivity gains and more efficient, higher velocity, more flexible capital expenditures.

No competitive advantage lasts forever. Competitive advantages must be defended diligently.

Jeff Bezos is fond of saying it’s Day 1 at Amazon. In his 2016 letter to shareholders he outlined four essentials for remaining in Day 1:

- True Customer Obsession

- Resist Proxies

- Embrace External Trends

- High-Velocity Decision-Making

I’ll briefly quote Bezos on each.

True Customer Obsession:

Customers are always beautifully, wonderfully dissatisfied, even when they report being happy and business is great. Even when they don’t yet know it, customers want something better, and your desire to delight customers will drive you to invent on their behalf. No customer ever asked Amazon to create the Prime membership program, but it sure turns out they wanted it, and I could give you many such examples.

Resist Proxies:

A common example is process as proxy… You stop looking at outcomes and just make sure you’re doing the process right…. The process is not the thing. It’s always worth asking, do we own the process of does the process own us. In a Day 2 company, you might find it’s the second.

Another example: market research and customer surveys can become proxies for customers… Good inventors and designers deeply understand their customer. They spend tremendous energy developing that intuition. They study and understand many anecdotes rather than only the averages you’ll find on surveys. They live with the design… I’m not against beta testing or surveys. But you, the product or service owner, must understand the customer, have a vision, and love the offering. Then, beta testing and research can help you find your blind spots. A remarkable customer experience starts with heart, intuition, curiosity, play, guts, taste. You won’t find any of it in a survey.

Embrace External Trends:

If you fight them, you’re probably fighting the future. Embrace them and you have a tailwind. These big trends are not that hard to spot (they get talked and written about a lot), but they can be strangely hard for large organizations to embrace. We’re in the middle of an obvious one right now: machine learning and artificial intelligence.

High-Velocity Decision Making:

Day 2 companies make high-quality decisions, but they make high quality decisions slowly. To keep the energy and dynamism of Day 1, you have to somehow make high-quality, high-velocity decisions… First, never use a one-size-fits-all decision-making process. Many decisions are reversible, two-way doors. Those decisions can use a light-weight process. For those, so what if you’re wrong? Second, most decisions should probably be made with somewhere around 70% of the information you wish you had. If you wait for 90%, in most cases, you’re probably being too slow. Plus, either way, you need to be good at quickly recognizing and correcting bad decisions. If you’re good at course correcting, being wrong may be less costly than you think, whereas being slow is going to be expensive for sure. Third, use the phrase “disagree and commit". This phrase will save you a lot of time. If you have conviction on a particular direction even though there’s no consensus, it’s helpful to say, “Look, I know we disagree on this but will you gamble with me on it? Disagree and commit?" By the time you’re at this point, no one can know the answer for sure, and you’ll probably get a quick yes. [JC note – use this for low-cost decisions i.e. don’t bet the house in this manner if you can avoid it!]

Fourth, recognize true misalignment issues early and escalate them immediately. Sometimes teams have different objectives and fundamentally different views. They are not aligned... When we decided to invite third party sellers to compete directly against us on our own product detail pages – that was a big one. Many smart, well-intentioned Amazonians were simply not at all aligned with that direction.

So, have you settled only for decision quality, or are you mindful of decision velocity too? Are the world’s trends tailwinds for you? Are you falling prey to proxies, or do they serve you? And most important of all, are you delighting customers?

Closing comments:

Network effects businesses naturally share their benefits with network participants due to their very nature – the value proposition to all participants in the system grows as a direct result of the number of system participants growing. SES businesses need more intentional ‘pushing’ in the right direction. Scaled SES businesses, if properly defended, can be as dominant and as durable as businesses benefitting from network effects.

There are four questions you must ask:

- Is this a business in which per unit costs decline as production volumes increase?

- Is management clearly taking action to increase the value proposition to its customers as it adds more customers, working backwards from customer needs?

- Is the company's culture deeply aligned with customers and the 'SES' mission?

- Is the customer value proposition increasing relative to competitors over time?

It’s important that the business has some degree of customer captivity as they scale – typically it’s switching costs, but it could also be brand and/or network effects. If all they can have is economies of scale, it will be very difficult to keep customers if someone comes along discounting prices irrationally.

The lower the customer captivity (i.e. the switching costs/brand/network effects), the more "sharing" is required:

I generally avoid companies that have economies of scale but don’t share those scale benefits with their customers, or who raise prices faster than they increase their value proposition to customers. Exceptions to this include:

- Situations where the customer ROI is already so high and so much higher than any alternatives that the business has a long runway to raise prices before the customer ROI is no longer exceptional.

- Situations where the customer captivity is at the far right of the above spectrum.

- When scale can & should be used to acquire customers more aggressively in the short-medium term.

If you find a business that is building a SES business model with a long runway for reinvestment that will delight customers, and with a management team that understands its customers needs and works backwards from there, then invest in size and hold on for the ride – and get in contact with me to tell me what the business is!

Many other SES businesses have been wonderful investments historically:

No competitive advantage lasts forever. Just look at Intel. Competitive advantages must be defended diligently.

Appendices:

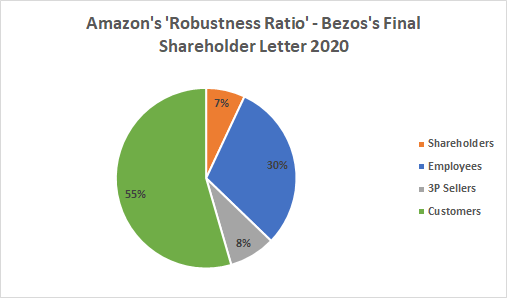

The Robustness Ratio:

Nomad Partners coined this term in their excellent letters to investors. They discuss Costco under this light (taking the idea initially from Buffett's discussion of Geico).

In Bezos's 2020 letter to shareholders, Bezos discusses this in the context of Amazon. On his numbers, we see the following (numbers in USD billions):

This is impressive.! Both in percentage terms and in the absolute number.

However, all-in-all I think Bezos was too conservative here with respect to returns for shareholders and for customers. I would contend he was a bit too generous with respect to employees, given that employees could conceivably work at other firms (albeit likely at lower wages).

I will discuss this in-depth in a future post, but suffice to say Bezos's estimates are conservative.

Jeff Bezos:

“We believe that a fundamental measure of our success will be the shareholder value we create over the long term. This value will be a direct result of our ability to extend and solidify our current market leadership position. The stronger our market leadership, the more powerful our economic model. Market leadership can translate directly to higher revenue, higher profitability, greater capital velocity, and correspondingly stronger returns on invested capital.

“Our decisions have consistently reflected this focus. We first measure ourselves in terms of the metrics most indicative of our market leadership: customer and revenue growth, the degree to which our customers continue to purchase from us on a repeat basis, and the strength of our brand.

“We will continue to measure our programs and the effectiveness of our investments analytically, to jettison those that do not provide acceptable returns, and to step up our investment in those that work best. We will continue to learn from both our successes and our failures.

“We will make bold rather than timid investment decisions where we see a sufficient probability of gaining market leadership advantages. Some of these investments will pay off, others will not, and we will have learned another valuable lesson in either case… When forced to choose between optimizing the appearance of our GAAP accounting and maximizing the present value of future cash flows, we’ll take the cash flows.

“We dramatically lowered prices, further increasing customer value. Word of mouth remains the most powerful customer acquisition tool we have, and we are grateful for the trust our customers have placed in us. Repeat purchases and word of mouth have combined to make Amazon.com the market leader in online bookselling.” – 1997

“each new product or service further leverages our investments in distribution, customer service, technology, and brand, and can yield increased leverage on our bottom line.

“Often, the best way to drive one of these is to deliver the other. For instance, more efficient distribution yields faster delivery times, which in turn lowers contacts per order and customer service costs. These, in turn, improve customer experience and build brand, which in turn decreases customer acquisition and retention costs.

“Each of the previous goals I’ve outlined contribute to our long-standing objective of building the best, most profitable, highest return on capital, long-term franchise. So in a way, driving profitability is the foundation underlying all of these goals. In the coming year, we expect to deliver substantial margin improvement and cost leverage as we drive continuous improvement in our partnerships with suppliers, in our productivity and efficiency, in our management of fixed and working capital, and our expertise in managing product mix and price.” – 1999

“Online selling (relative to traditional retailing) is a scale business characterized by high fixed costs and relatively low variable costs. This makes it difficult to be a medium-sized e-commerce company.” – 2000

“Focus on cost improvements makes it possible for us to afford to lower prices, which drives growth. Growth spreads fixed costs across more sales, reducing cost per unit, which makes possible more price reductions. Customers like this, and it’s good for shareholders. Please expect us to repeat this loop.

“one of the most important things we’ve done to improve convenience and experience for customers also happens to be a huge driver of variable cost productivity: eliminating mistakes and errors at their root. Every year that’s gone by since Amazon.com’s founding, we’ve done a better and better job of eliminating errors, and this past year was our best ever. Eliminating the root causes of errors saves us money and saves customers time.” – 2001

“in many ways, Amazon.com is not a normal store. We have deep selection that is unconstrained by shelf space. We turn our inventory 19 times in a year. We personalize the store for each and every customer. We trade real estate for technology (which gets cheaper and more capable every year). We display customer reviews critical of our products. You can make a purchase with a few seconds and one click. We put used products next to new ones so you can choose. We share our prime real estate – our product detail pages – with third parties, and, if they can offer better value, we let them.

“One of our most exciting peculiarities is poorly understood. People see that we’re determined to offer both world-leading customer experience and the lowest possible prices, but to some this dual goal seems paradoxical if not downright quixotic. Traditional stores face a time-tested tradeoff between offering high-touch customer experience on the one hand and the lowest possible prices on the other. How can Amazon.com be trying to do both?

“The answer is that we transform much of customer experience – such as unmatched selection, extensive product information, personalized recommendations, and other new software features – into largely a fixed expense. With customer experience costs largely fixed (more like a publishing model than a retailing model), our costs as a percentage of sales can shrink rapidly as we grow our business. Moreover, customer experience costs that remain variable – such as the variable portion of fulfillment costs – improve in our model as we reduce defects. Eliminating defects improves costs and leads to better customer experience. We believe our ability to lower prices and simultaneously drive customer experience is a big deal, and this past year offers evidence that the strategy is working.” – 2002

“At Amazon.com, we use the term customer experience broadly. It includes every customer-facing aspect of our business – from our product prices to our selection, from our website’s user interface to how we package and ship items. The customer experience we create is by far the most important driver of our business.

“shortly after launching Amazon.com in 1995, we empowered customers to review products. While now a routine Amazon.com practice, at the time we received complaints from a few vendors, basically wondering if we understood our business: “You make money when you sell things – why would you allow negative reviews on your website?” Speaking as a focus group of one, I know I’ve sometimes changed my mind before making purchases on Amazon.com as a result of negative or lukewarm customer reviews. Though negative reviews cost us some sales in the short term, helping customers make better purchase decisions ultimately pays off for the company.

“… Good for customers? Definitely. Good for shareowners? Yes, in the long run.

“Among the most expensive customer experience improvements we’re focused on are our everyday free-shipping offers and our ongoing product price reductions. Eliminating defects, improving productivity, and passing the resulting costs savings back to customers in the form of lower prices is a long-term decision. Increased volumes take time to materialize, and price reductions almost always hurt current results. In the long-term, however, relentlessly driving the “price-cost structure loop” will leave us with a stronger, more valuable business. Since many of our costs, such as software engineering, are relatively fixed and many of our variable costs can also be better managed at larger scale, driving more volume through our cost structure reduces those costs as a percentage of sales. To give one small example, engineering a feature like Instant Order Update for use by 40 million customers costs nowhere near 40 times what it would cost to do the same for 1 million customers.

“Our pricing strategy does not attempt to maximize margin percentages, but instead seeks to drive maximum value for customers and thereby create a much larger bottom line – in the long term.” – 2003

“we have made a decision to continuously and significantly lower prices for customers year after year as our efficiency and scale make it possible. This is an example of a very important decision that cannot be made in a math-based way. In fact, when we lower prices, we go against the math that we can do, which always says that the smart move is to raise prices. We have significant data related to price elasticity. With fair accuracy, we can predict that a price reduction of a certain percentage will result in an increase in units sold of a certain percentage. With rare exceptions, the volume increase in the short term is never enough to pay for the price decrease. However, our quantitative understanding of elasticity is short-term. We can estimate what a price reduction will do this week and this quarter. But we cannot numerically estimate the effect that consistently lowering prices will have on our business over five years or ten years or more. Our judgment is that relentlessly returning efficiency improvements and scale economies to customers in the form of lower prices creates a virtuous cycle that leads over the long term to a much larger dollar amount of free cash flow, and thereby to a much more valuable Amazon.com. We’ve made similar judgments around Free Super Saver Shipping and Amazon Prime, both of which are expensive in the short term and—we believe—important and valuable in the long term.

“As another example, in 2000 we invited third parties to compete directly against us on our “prime retail real estate”—our product detail pages. Launching a single detail page for both Amazon retail and third-party items seemed risky. Well-meaning people internally and externally worried it would cannibalize Amazon’s retail business, and—as is often the case with consumer-focused innovations—there was no way to prove in advance that it would work. Our buyers pointed out that inviting third parties onto Amazon.com would make inventory forecasting more difficult and that we could get “stuck” with excess inventory if we “lost the detail page” to one of our third-party sellers. However, our judgment was simple. If a third party could offer a better price or better availability on a particular item, then we wanted our customer to get easy access to that offer. Over time, thirdparty sales have become a successful and significant part of our business. Third-party units have grown from 6% of total units sold in 2000 to 28% in 2005, even as retail revenues have grown three-fold.

“We’ll start with the customer and work backwards. In our judgment, that is the best way to create shareholder value.” – 2005

“Customer Experience Pillars In our retail business, we have strong conviction that customers value low prices, vast selection, and fast, convenient delivery and that these needs will remain stable over time. It is difficult for us to imagine that ten years from now, customers will want higher prices, less selection, or slower delivery. Our belief in the durability of these pillars is what gives us the confidence required to invest in strengthening them. We know that the energy we put in now will continue to pay dividends well into the future. Our pricing objective is to earn customer trust, not to optimize short-term profit dollars. We take it as an article of faith that pricing in this manner is the best way to grow our aggregate profit dollars over the long term. We may make less per item, but by consistently earning trust we will sell many more items. Therefore, we offer low prices across our entire product range. For the same reason, we continue to invest in our free shipping programs, including Amazon Prime. Customers are well-informed and smart, and they evaluate the total cost, including delivery charges, when making their purchasing decisions. In the last 12 months, customers worldwide have saved more than $800 million by taking advantage of our free shipping offers. We’re relentlessly focused on adding selection, both by increasing selection inside existing categories and by adding new categories. We’ve added 28 new categories since 2007. One business that is rapidly growing and continues to surprise me is our shoe store, Endless.com, which we launched in 2007.

“Fast, reliable delivery is important to customers. In 2005, we launched Amazon Prime. For $79 per year,1 Prime members get unlimited express two-day shipping for free and upgrades to one-day delivery for just $3.99. In 2007, we launched Fulfillment by Amazon, a new service for third-party sellers. With FBA, sellers warehouse their inventory in our global fulfillment network, and we pick, pack, and ship to the end customer on the sellers’ behalf. FBA items are eligible for Amazon Prime and Super Saver Shipping – just as if the items were Amazon-owned inventory. As a result, FBA both improves the customer experience and drives seller sales. In the fourth quarter of 2008, we shipped more than 3 million units on behalf of sellers who use Fulfillment by Amazon, a win-win for customers and sellers.

“Even as the rate of change accelerates, we hope and believe our focus on what stays the same should serve us well.” – 2008

“Invention comes in many forms and at many scales. The most radical and transformative of inventions are often those that empower others to unleash their creativity – to pursue their dreams. That’s a big part of what’s going on with Amazon Web Services, Fulfillment by Amazon, and Kindle Direct Publishing. With AWS, FBA, and KDP, we are creating powerful self-service platforms that allow thousands of people to boldly experiment and accomplish things that would otherwise be impossible or impractical. These innovative, large-scale platforms are not zero-sum – they create win-win situations and create significant value for developers, entrepreneurs, customers, authors, and readers.” – 2011 (Bezos on platforms…)

“Our business approach is to sell premium hardware at roughly breakeven prices. We want to make money when people use our devices – not when people buy our devices. We think this aligns us better with customers. For example, we don’t need our customers to be on the upgrade treadmill. We can be very happy to see people still using four-year-old Kindles!

“Our heavy investments in Prime, AWS, Kindle, digital media, and customer experience in general strike some as too generous, shareholder indifferent, or even at odds with being a for-profit company. “Amazon, as far as I can tell, is a charitable organization being run by elements of the investment community for the benefit of consumers,” writes one outside observer. But I don’t think so. To me, trying to dole out improvements in a justin-time fashion would be too clever by half. It would be risky in a world as fast-moving as the one we all live in. More fundamentally, I think long-term thinking squares the circle. Proactively delighting customers earns trust, which earns more business from those customers, even in new business arenas. Take a long-term view, and the interests of customers and shareholders align.” – 2012

“The number of sellers using Fulfillment by Amazon grew more than 65% last year. Growth like that at large scale is unusual. FBA is unique in many ways. It’s not often you get to delight two customer sets with one program. With FBA, sellers can store their products in our fulfillment centers, and we pick, pack, ship, and provide customer service for these products. Sellers benefit from one of the most advanced fulfillment networks in the world, easily scaling their businesses to reach millions of customers. And not just any customers – Prime members. FBA products can be eligible for Prime free two-day shipping. Customers benefit from this additional selection – they get even more value out of their Prime membership. And, unsurprisingly, sellers see increased sales when they join FBA. In a 2013 survey, nearly three out of four FBA respondents reported that their unit sales increased on Amazon.com more than 20% after joining FBA. It’s a win-win.” – 2013

“A dreamy business offering has at least four characteristics. Customers love it, it can grow to very large size, it has strong returns on capital, and it’s durable in time – with the potential to endure for decades. When you find one of these, don’t just swipe right, get married.

“Marketplace… the idea was to take our most valuable retail real estate – our product detail pages – and let third-party sellers compete against our own retail category managers. It was more convenient for customers… The success of this hybrid model accelerated the Amazon flywheel. Customers were initially drawn by our fast-growing selection of Amazon-sold products at great prices with a great customer experience. By then allowing third parties to offer products side-by-side, we became more attractive to customers, which drew even more sellers. This also added to our economies of scale, which we passed along by lowering prices and eliminating shipping fees for qualifying orders. Having introduced these programs in the U.S., we rolled them out as quickly as we could to our other geographies. The result was a marketplace that became seamlessly integrated with all of our global websites.” – 2015

“Amazon Prime… Ten years ago, we launched Amazon Prime, originally designed as an all-you-can-eat free and fast shipping program. We were told repeatedly that it was a risky move, and in some ways it was. In its first year, we gave up many millions of dollars in shipping revenue, and there was no simple math to show that it would be worth it. Our decision to go ahead was built on the positive results we’d seen earlier when we introduced Free Super Saver Shipping, and an intuition that customers would quickly grasp that they were being offered the best deal in the history of shopping. In addition, analysis told us that, if we achieved scale, we would be able to significantly lower the cost of fast shipping.

“Our owned-inventory retail business was the foundation of Prime. In addition to creating retail teams to build each of our category-specific online “stores,” we have created large-scale systems to automate much of inventory replenishment, inventory placement, and product pricing. The precise delivery-date promise of Prime required operating our fulfillment centers in a new way, and pulling all of this together is one of the great accomplishments of our global operations team.

“Our owned inventory retail business remains our best customer-acquisition vehicle for Prime and a critical part of building out categories that attract traffic and third-party sellers.

“Though fast delivery remains a core Prime benefit, we are finding new ways to pump energy into Prime. Two of the most important are digital and devices.

“In 2011 we added Prime Instant Video as a benefit, now with tens of thousands of movies and TV episodes available for unlimited streaming in the U.S., and we’ve started expanding the program into the U.K. and Germany as well. We’re investing a significant amount on this content, and it’s important that we monitor its impact. We ask ourselves, is it worth it? Is it driving Prime? Among other things, we watch Prime free trial starts, conversion to paid membership, renewal rates, and product purchase rates by members entering through this channel. We like what we see so far and plan to keep investing here.

“While most of our PIV spend is on licensed content, we’re also starting to develop original content. An advantage of our original programming is that its first run is on Prime – it hasn’t already appeared anywhere else. Together with the quality of the shows, that first run status appears to be one of the factors leading to the attractive numbers. We also like the fixed cost nature of original programming. We get to spread that fixed cost across our large membership base. Finally, our business model for original content is unique. I’m pretty sure we’re the first company to have figured out how to make winning a Golden Globe pay off in increased sales of power tools and baby wipes!

“Prime isn’t done improving on its original fast and free shipping promise either. The recently launched Prime Now offers Prime members free two-hour delivery on tens of thousands of items or one-hour delivery for a $7.99 fee.

“Now, I’d like to talk about Fulfillment by Amazon. FBA is so important because it is glue that inextricably links Marketplace and Prime. Thanks to FBA, Marketplace and Prime are no longer two things. In fact, at this point, I can’t really think about them separately. Their economics and customer experiences are now happily and deeply intertwined.

“FBA is a service for Marketplace sellers. When a seller decides to use FBA, they stow their inventory in our fulfillment centers. We take on all logistics, customer service, and product returns. If a customer orders an FBA item and an Amazon owned-inventory item, we can ship both items to the customer in one box – a huge efficiency gain. But even more important, when a seller joins FBA, their items can become Prime eligible.

“Maintaining a firm grasp of the obvious is more difficult than one would think it should be. But it’s useful to try. If you ask, what do sellers want? The correct (and obvious) answer is: they want more sales. So, what happens when sellers join FBA and their items become Prime eligible? They get more sales.

“Notice also what happens from a Prime member’s point of view. Every time a seller joins FBA, Prime members get more Prime eligible selection. The value of membership goes up. This is powerful for our flywheel. FBA completes the circle: Marketplace pumps energy into Prime, and Prime pumps energy into Marketplace. FBA is a win for customers and a win for sellers.

“large enterprises have been coming on board as well, and they’re choosing to use AWS for the same primary reason the startups did: speed and agility. Having lower IT cost is attractive, and sometimes the absolute cost savings can be enormous. But cost savings alone could never overcome deficiencies in performance or functionality. Enterprises are dependent on IT – it’s mission critical. So, the proposition, “I can save you a significant amount on your annual IT bill and my service is almost as good as what you have now,” won’t get too many customers. What customers really want in this arena is “better and faster,” and if “better and faster” can come with a side dish of cost savings, terrific. But the cost savings is the gravy, not the steak.

“IT is so high leverage. If an IT department can figure out how to deliver a larger number of business-enabling technology projects faster, they’ll be creating significant and real value for their organization.

“These are the main reasons AWS is growing so quickly. IT departments are recognizing that when they adopt AWS, they get more done. They spend less time on low value-add activities like managing datacenters, networking, operating system patches, capacity planning, database scaling, and so on and so on. Just as important, they get access to powerful APIs and tools that dramatically simplify building scalable, secure, robust, high-performance systems. And those APIs and tools are continuously and seamlessly upgraded behind the scenes, without customer effort.

“We’ve increased our pace of innovation as we’ve gone along – from nearly 160 new features and services in 2012, to 280 in 2013, and 516 last year.

“its current leadership position (which is significant) is a strong ongoing advantage. We work hard – very hard – to make AWS as easy to use as possible. Even so, it’s still a necessarily complex set of tools with rich functionality and a non-trivial learning curve. Once you’ve become proficient at building complex systems with AWS, you do not want to have to learn a new set of tools and APIs assuming the set you already understand works for you. This is in no way something we can rest on, but if we continue to serve our customers in a truly outstanding way, they will have a rational preference to stick with us.

“In addition, also because of our leadership position, we now have thousands of what are effectively AWS ambassadors roaming the world. Software developers changing jobs, moving from one company to another, become our best sales people: “We used AWS where I used to work, and we should consider it here. I think we’d get more done.” It’s a good sign that proficiency with AWS and its services is already something software developers are adding to their resumes.

“Finally, I’m optimistic that AWS will have strong returns on capital. This is one we as a team examine because AWS is capital intensive. The good news is we like what we see when we do these analyses. Structurally, AWS is far less capital intensive than the mode it’s replacing – do-it-yourself datacenters – which have low utilization rates, almost always below 20%. Pooling of workloads across customers gives AWS much higher utilization rates, and correspondingly higher capital efficiency. Further, once again our leadership position helps: scale economies can provide us a relative advantage on capital efficiency. We’ll continue to watch and shape the business for good returns on capital.” – 2015

“there are certain things that only large companies can do. With a tip of the hat to our Seattle neighbors, no matter how good an entrepreneur you are, you’re not going to build an all-composite 787 in your garage startup – not one you’d want to fly in anyway. Used well, our scale enables us to build services for customers that we could otherwise never even contemplate. But also, if we’re not vigilant and thoughtful, size could slow us down and diminish our inventiveness.

“We want Prime to be such a good value, you’d be irresponsible not to be a member.

“We’ve grown Prime two-day delivery selection from 1 million items to over 30 million, added Sunday Delivery, and introduced Free Same-Day Delivery on hundreds of thousands of products for customers in more than 35 cities around the world. We’ve added music, photo storage, the Kindle Owners’ Lending Library, and streaming films and TV.

“These shows are great for customers, and they feed the Prime flywheel – Prime members who watch Prime Video are more likely to convert from a free trial to a paid membership, and more likely to renew their annual subscriptions.

“Prime has become an all-you-can-eat, physical-digital hybrid that members love. Membership grew 51% last year – including 47% growth in the U.S. and even faster internationally – and there are now tens of millions of members worldwide. There’s a good change you’re already one of them, but if you’re not – please be responsible – join Prime.

“With FBA, that flywheel spins faster because sellers’ inventory becomes Prime-eligible – Prime becomes more valuable for members, and sellers sell more.

“As with our retail business, AWS is made up of many small teams with single-threaded owners, enabling rapid innovation. The team rolls out new functionality almost daily across 70 services, and that new functionality just “shows up” for customers – there’s no upgrading.

“Our approach to pricing is also driven by our customer-centric culture – we’ve dropped prices 51 times, in many cases before there was any competitive pressure to do so. In addition to price reductions, we’ve also continued to launch new lower cost services like Aurora, Redshift, QuickSight (our new Business Intelligence service), EC2 Container Service (our new compute container service), and Lambda (our pioneering server-less computing capability), while extending our services to offer a range of highly cost-effective options for running just about every type of application or IT use case imaginable. We even roll out and continuously improve services like Trusted Advisor, which alerts customers when they can save money – resulting in hundreds of millions of dollars in savings for our customers. I’m pretty sure we’re the only IT vendor telling customers how to stop spending money with us.

“AWS is already good enough today to attract more than 1 million customers, and the service is only going to get better from here. As the team continues their rapid pace of innovation, we’ll offer more and more capabilities to let builders build unfettered, it will get easier and easier to collect, store and analyze data, we’ll continue to add more geographic locations, and we’ll continue to see growth in mobile and “connected” device applications. Over time, it’s likely that most companies will choose not to run their own data centers, opting for the cloud instead.” – 2015

Charles Schwab:

“A focus on growth doesn’t mean being the most profitable company in your industry. I didn’t want to be the most profitable. I wanted to be the one that was always thinking about growth and how we could find the resources to be innovative. I always believed that profits were something that come naturally at the end of the line, if you got the first part right – finding new ways to help the customer succeed.

“Charles Merrill, founder of Merrill Lynch, used to say, “Stocks aren’t bought, they’re sold”. We came at it from exactly the opposite direction. In our case, the customer initiated the transaction, not the broker. We weren’t out there buying lunches for clients or taking them golfing. We weren’t calling anybody up with hot tips. In fact, I’d fire people if they gave stock advice. Nothing happened unless the customer asked first. Our only role was to carry out the customer’s wishes. Period.

“We were always very aggressive about best execution – getting the best possible price for our clients. The whole way we operated was designed not just to take what the market was offering but also to manage the order as best as we could. That was the value we added. Remember, we weren’t offering advice. Just quick, clean, efficient, accurate execution under the best possible terms. I designed Schwab from day one to be the kind of firm I myself would want to do business with. If we let our customers down, I knew exactly how they felt.

“Nothing compares to word of mouth… It was true then, and is truer today, with the explosion of social media.

“Being big is important, but not big for big’s sake, but because it enables you to invest and improve the services you provide. Being big meant expanding revenue to reinvest and improve; that required growth.

Meredith Kopit Levien:

“The larger our subscriber base becomes, the more we can invest in our journalism and stand-alone products and the more we can spread our fixed costs across a wider base of users. That means strong unit economics that improve as we scale with further contributions from advertising, licensing and affiliate fees.

“We're also not reliant on any single story or topic to drive our growth. In fact, the breadth of our core news report is both a differentiator and a driver of our business.

“Our user data tells us that each additional topic that someone engages with increases their likelihood of subscribing by 50%, and while politics is an important topic for our readers, around 80% go beyond politics to read other subjects each week.” – 2020 Q3 earnings call.

Mark Thompson:

“Podcasting and audio point to a future where the consumption of news and journalism may be more interactive, may happen very fluidly between moments when users can read and moments when they’re commuting or they’ve got their earphones in and they’re exercising. And ultimately, it may be interrogatory, where the way you get news is by asking questions and getting answers to questions, as opposed to listening to something that is being read out as if it was a speaking book or an audio novel.

“The internet was expected to produce plenty, and therefore, ferocious competition. But what we’re talking about is outstanding, professionally made, thoughtful, global news coverage. I would say the list of competitors is not very big and the trends in the business are going to make it harder to launch or to grow, rather than easier, in the coming years.

“We’re not going to put enough journalists in Australia to fully cover Australia, to compete head to head with local media and local journalism there. Our thesis is about “local for global”. We’re going to cover those stories in Australia that hopefully will be interesting to subscribers in Australia but actually are interesting to subscribers everywhere.

“The barriers to entry are very high for this kind of high-quality journalism.

“in 2012, the Times was probably doing about 50 million “uniques” a month. We did 240 million uniques in March 2020. Now that was a COVID-19-focused month, but that’s almost five times as much at the top of the funnel, which is not our main focus. Our main focus is actually around engaged users. But the simple scaling of the audience, the fact that hundreds of millions more are getting something out of The Times than was true eight years ago, is testimony to the fact that if you think big, it takes you to a very different place – if you don’t have the psychological barriers of having grown up in an industry where typically publications will get half a million, a million subscribers and be done.

“If we get better and better at organic growth – in other words, growth in digital subscriptions based on engagement and consumption of the product itself, as opposed to growth achieved through paid marketing – then, over time, we’ll see the revenue of the company grow far faster than its cost base and the profitability of the operating leverage get better and better. So the broader idea of trying to deepen and broaden engagement – to broaden the appeal of the organization and to get smarter about how you attract people of different levels of income, in different cultural contexts and so on – is the way forward. The ultimate scale of the thing could be really immense – maybe 50 times, 30 times what the ambitions of the company were when it launched the pay model in 2011.” – Building a Digital New York Times

Resources:

- Brad Stone’s ‘The Everything Store’

- Jeff Bezos’s annual letters to shareholders

- Charles Schwab’s autobiography: ‘Invested’

- Charles Schwab company filings

- NYT company filings

- The Fine Line Between When Low Prices Work and When They Don’t (hbr.org)

- Zack Kanter: What is Amazon?

- Ensemble Capital’s ‘Schwab Kills Commissions to Feed its Flywheel of Scale’